The PPP was created as part of the CARES Act to assist small businesses and eligible nonprofits in maintaining their payroll during the COVID-19 pandemic. Generally, the PPP loan is fully forgivable if employers retain employees at salary levels comparable to those before the pandemic. If there is any remaining non-forgivable PPP loan, the loan generally has a maturity of 5 years and a 1% interest rate.

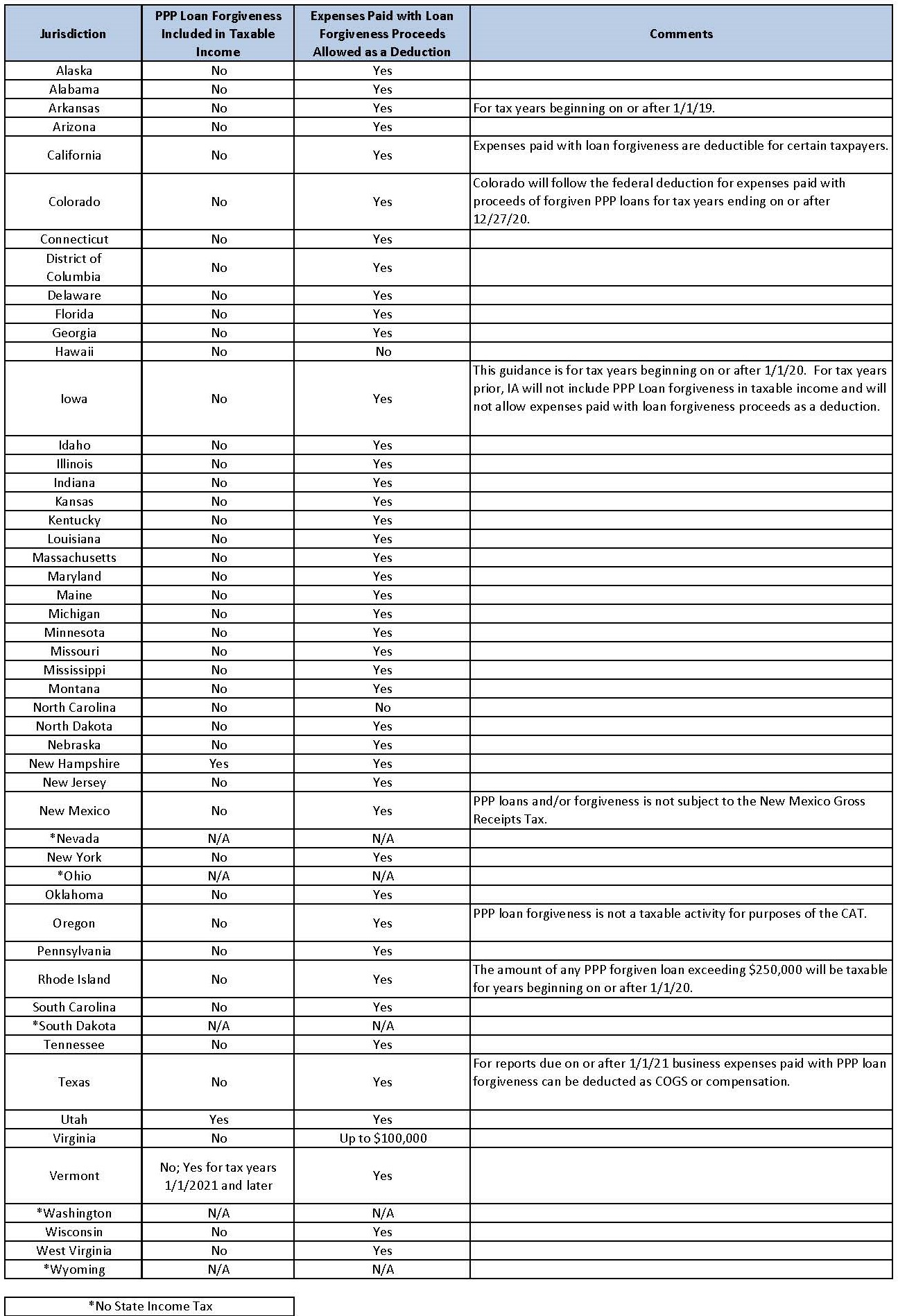

For the federal purposes, forgiven PPP loans will not count as taxable income, and the expenses paid for by the PPP proceeds are deductible. However, it is not as straightforward for individual states. Many states will exclude forgiven PPP loans from taxable income and allow a deduction for related expenses, following the federal treatment. However, some states may treat the forgiveness and expense deduction differently. The chart below shows each state’s tax treatment of PPP loan forgiveness and related expenses. (Click to enlarge)

It is important to carefully assess the state tax effects of PPP loan forgiveness and closely review the state’s response to the CARES Act.