Protective Form 1120-F

Foreign corporations are subject to US tax on their income that is effectively connected to a US trade or business (ECI). In general, US trade or business exists where there are regular, continuous, considerable commercial activities in pursuit of profit within the United States, whether the activity is undertaken directly or through an agent.

If the foreign corporation is resident in a county that has an income tax treaty with the US, business profits associated with US trade of business are taxable by the US government if the income is attributable to a permanent establishment (PE). In general, a PE requires a more stable or permanent business connection with the US. Therefore, it is possible for a foreign corporation to be engaged in a US trade or business without rising to the level of PE.

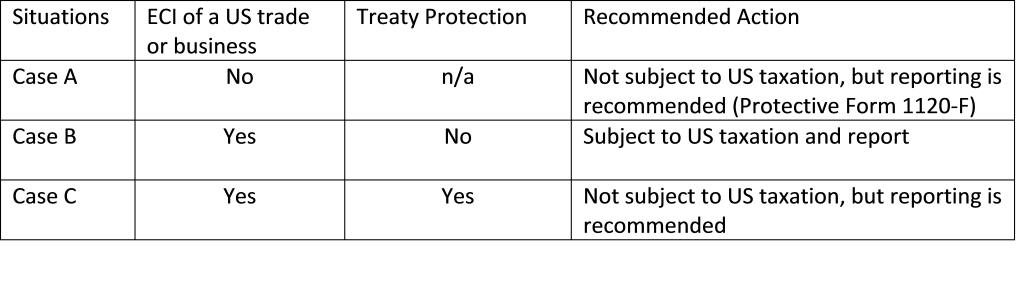

Therefore, foreign enterprises must perform an analysis to determine whether or not it derives income that is effectively connected to a US trade or business and, if so, whether or not such activity is protected under the respective income tax treaty.

The following chart will assist in visualizing the outcome of the analysis and recommended actions:

In the case B, where a foreign corporation has income effectively connected with a US trade or business, and its activity in the US rises to the level of PE, the corporation is subject to US taxation and reporting.

In the case A, where a foreign corporation has no ECI associated with US trade or business, the enterprise is not subject to US taxation. However, Protective Form 1120-F is recommended.

For purposes of computing U.S. taxable income, foreign corporations are generally permitted to arrive at net taxable income by taking into account allowable deductions and credits. However, such deductions and credits are subject to Treas. Reg. 1.882-4(a)(3)(i), which generally requires Form 1120-F be filed within 18 months of the due date of the tax return. No deduction and credits are allowed if Form 1120-F for the respective tax year has not been filed within 18 months after the due date of the return.

If the IRS were to challenge such position (that the enterprise has no ECI nor PE) and prevails, tax assessment will be made on the foreign corporation’s gross income, rather than on net profits, since Form 1120-F has not been filed pursuant to Treas. Reg. 1.882-4(a)(3)(i). Thus, we recommend protective Form 1120-F be filed to manage the risk of losing allowable deductions and credits.

In the case C, where a foreign corporation has ECI associated with US trade or business, but engages in a US trade of business without rising to the level of PE, the enterprise is not subject to US taxation but Form 1120-F is recommended to be filed.

Foreign corporations that determine they do not have a US PE in the U.S. under an applicable income tax treaty should consider filing a protective return. In this cash, such foreign corporation are generally required to file a Treaty Based Return Position (Form 8833) with Form 1120-F to assert the treaty exemption claim. Timely filing a protective return preserves the foreign corporation’s right to offset income with allowable deductions and credit should the IRS subsequently assert the company does have a taxable US PE.

***

Foreign corporations who fail to file Form 1120-F within 18 months of the due date may seek for relief under Treas. Reg. 1.882-4(a)(3)(ii) if the foreign corporation establishes to the satisfaction of the IRS Commissioner that the foreign corporation acted reasonably and in good faith in failing to file a US tax return including a protective tax return.