Mandatory Repatriation & Its Impact to Individuals

One of the most significant provisions contained in the 2017 Tax Cuts and Jobs Act (the “New Tax Law”) is the mandatory repatriation under Internal Revenue Code (“IRC”) section 965 and a modification to the attribution rule under section 958. Our office has received numerous calls with questions related to the mandatory repatriation and we thought it would be helpful to summarize the rule and its potential impact to individual taxpayers.

What is Mandatory Repatriation Tax?

Generally, a U.S. shareholder of a foreign corporation is not subject to U.S. tax on the foreign earnings of such corporations until the earning is distributed to the shareholder (i.e. as a dividend). However, under the new mandatory repatriation rule under IRC section 965, a U.S. shareholder of a specified foreign corporation must include in its 2017 taxable income deferred foreign income determined as of November 2, 2017 or December 31, 2017 (whichever is greater) of such corporation. Such income is taxed at 15.5% for cash position and 8% for non-cash position.

A U.S. shareholder includes any U.S. person or corporation owning directly and indirectly 10% or more of the foreign corporation.

A specified foreign corporation is either (a) a controlled foreign corporation or (b) a foreign corporation in which a U.S. corporation owns 10% or more of voting power. A controlled foreign corporation is any foreign corporation if more than 50% of the total voting power of such corporation is owned directly, indirectly or constructively by U.S. shareholders.

Deferred foreign income is accumulated post-1986 Earnings & Profits (“E&P”) for the periods in which the corporation was a specified foreign corporation. E&P is the measure of a corporation’s economic ability to pay dividend. Foreign corporation’s E&P is determined based on IRC sections 312 and 964 and the accompanying regulations, cases and IRS guidance, and it is different from book retained earnings.

How Does Modification of Attribution Rule under IRC section 958 Impact Individual Taxpayers?

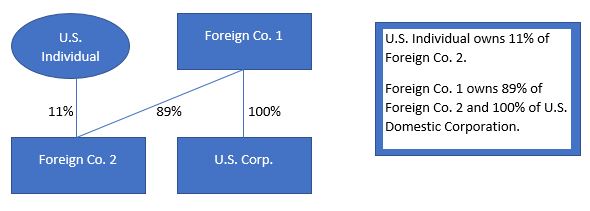

Under the New Tax Law, the attribution rules have changed, and US individuals need to pay attention to this change. The attribution rules are extremely complex and need to be analyzed on case-by-case basis. However, the below illustration may provide some insights to the adverse impact of the modification.

IRC section 318(a)(3)(C) provides that if 50% or more in value of the stock in a corporation is owned, directly or indirectly, by or for any person, such corporation shall be considered as owning the stock owned, directly or indirectly, by or for such person. Under prior law, this downward attribution rule was prohibited under IRC section 958(b)(4). However, the New Tax Law repealed the section 958(b)(4) of the code. Therefore, under the New Tax Law, because Foreign Co. 1 has a controlling interest (more than 50%) in U.S Corp., U.S Corp. is constructively owning the stock of Foreign Co. 2. As such, Foreign Co. 2 is considered as owned by U.S. Corp. Since Foreign Co. 2 is constructively owned by U.S. Corp., Foreign Co. 2 is considered as a controlled foreign corporation.

As Foreign Co. 2 is a controlled foreign corporation, it is a specified foreign corporation and its U.S. shareholder must report his or her pro-rata share of the foreign deferred income of Foreign Co. 2.

Takeaway

A primary impact of the repeal of section 958(b)(4) of the code would be to cause minority US owners of foreign corporations be as treated US shareholders of controlled foreign corporation as a result of attribution from the majority foreign owner and subject the U.S. shareholder for the 965 mandatory repatriation tax. Both the attributions rules and section 965 mandatory repatriation tax calculation are complex. Additionally, federal government has extended the statute of limitation related to this particular matter from the general 3 years to 6 years – indicating its intension to enforce compliance. Therefore, if you own directly and indirectly 10% or more of the stock of any foreign corporations, we recommend that you consult with a tax professional with an in-depth understanding and experience in international taxation.

Some tax practitioners argue that the legislative intent of the repeal of the section 958(b)(4) of the code is not intended to subject minority U.S. shareholders to the 965 mandatory repatriation tax if the foreign corporation were never previously under majority U.S. ownership (i.e. Decontrolled CFCs or Inverted Company). However, taking a return filing position contrary to the statutory language would subject taxpayers to the late payment penalties, substantial understatement of income penalties and accuracy-related penalties, in the absence of regulations or IRS guidance supporting such position.

THE INFORMATION CONTAINED HEREIN IS OF A GENERAL NATURE AND BASED ON AUTHORITIES THAT ARE SUBJECT TO CHANGE AND DIFFERING INTERPRETATION. APPLICABILITY OF THE INFORMATION TO SPECIFIC SITUATIONS SHOULD BE DETERMINED THROUGH CONSULATION WITH YOUR TAX ADVISER. ANY TAX ADVICE IN THIS COMMUNICATION IS NOT INTENDED TO BE USED AND CANNOT BE USED, BY A CLIENT OR ANY OTHER PERSON OR ENTITY FOR THE PURPOSE OF (i) AVOIDING PENALTIES THAT MAY BE IMPOSED ON ANY TAXPAYER OR (ii) PROMOTING, MARKETING OR RECOMMENDING TO ANOTHER PARTY ANY MATTERS ADDRESS HEREIN.