ASU 2018-02 Tax Effect Stranded In OCI

FASB issued ASU 2018-02 addressing tax effects stranded in Other Comprehensive Income (“OCI”) resulting from the enactment of the Tax Cuts and Jobs Act. This guidance is effective for all entities for fiscal years beginning after December 15, 2018, and early adoption is permitted.

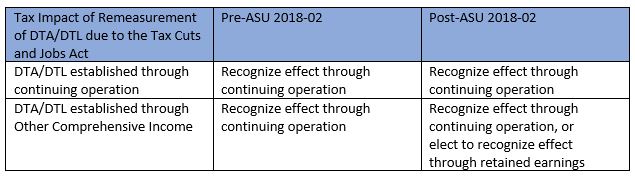

Under US GAAP, tax effect of change in a tax rate or law is recorded as a component of the income tax provision in the period of enactment. Therefore, the effects of remeasuring deferred tax assets and liabilities for the corporate rate reduction provision contained in the Tax Cuts and Jobs Act is recognized through component of income tax provision related to continuing operation. This is true for deferred tax assets and liabilities established through OCI.

FABS recognized that tax effect of remeasuring deferred tax assets and liabilities, originally established through OCI, through continuing operation may be perceived as disproportional. To address this concern, FASB issued ASU 2018-02 which gives an option to recognize tax effect stranded in OCI through retained earnings.

A link to ASU 2018-02 is provided below for your reference.

http://www.fasb.org/jsp/FASB/Document_C/DocumentPage?cid=1176170041017&acceptedDisclaimer=true